OLYMPIA… The second of this year’s quarterly state-revenue forecasts was adopted today by Sen. Chris Gildon and other members of the state Economic and Revenue Forecast Council.

OLYMPIA… The second of this year’s quarterly state-revenue forecasts was adopted today by Sen. Chris Gildon and other members of the state Economic and Revenue Forecast Council.

The new predictions from the state’s chief economist have revenue collections for the 2025-27 and 2027-29 operating-budget cycles falling $490 million and $638 million, respectively, from the first-quarter forecast in March.

When adopted April 27, the new 2025-27 operating budget – which takes effect in one week – had an ending fund balance of just $80 million, or 0.1% of the $77.9 billion in spending.

Today’s forecast led experts on the non-partisan Senate budget-committee staff to update the state’s budget outlook. It indicates big trouble ahead, said Gildon, R-Puyallup, with the ending fund balance for the 2025-27 budget falling to just $2 million, and a projected shortfall of $331 million in the 2027-29 budget cycle – although those numbers could change depending on the demand for core state services.

He offered this reaction:

“This forecast almost had the majority Democrats’ new budget falling out of balance before it took effect. That would have been an embarrassing first in our state, and there could still be big trouble ahead. A $2 million ending-fund balance is like a family of four with a median income having less than $3.50 in savings. And if there’s a $331 million shortfall even after all of the majority’s new taxes kick in, what then?

“While the governor tries to shift blame to the federal government, this simply highlights a combination of ineptitude, government greed and catering to special interests by his own state party. Our state didn’t quite hit the financial iceberg today, but it certainly lies dead ahead.

“This situation never should have been possible, considering our Democrat colleagues just approved the largest set of tax increases in state history – $12.2 billion over four years. But they knowingly and irresponsibly spent just about every penny available, while also ignoring problems like the state’s tort liability, which is taking up a growing share of the budget. To make things worse, today’s forecast also has job growth in Washington falling to and staying below 1% for the next four years.

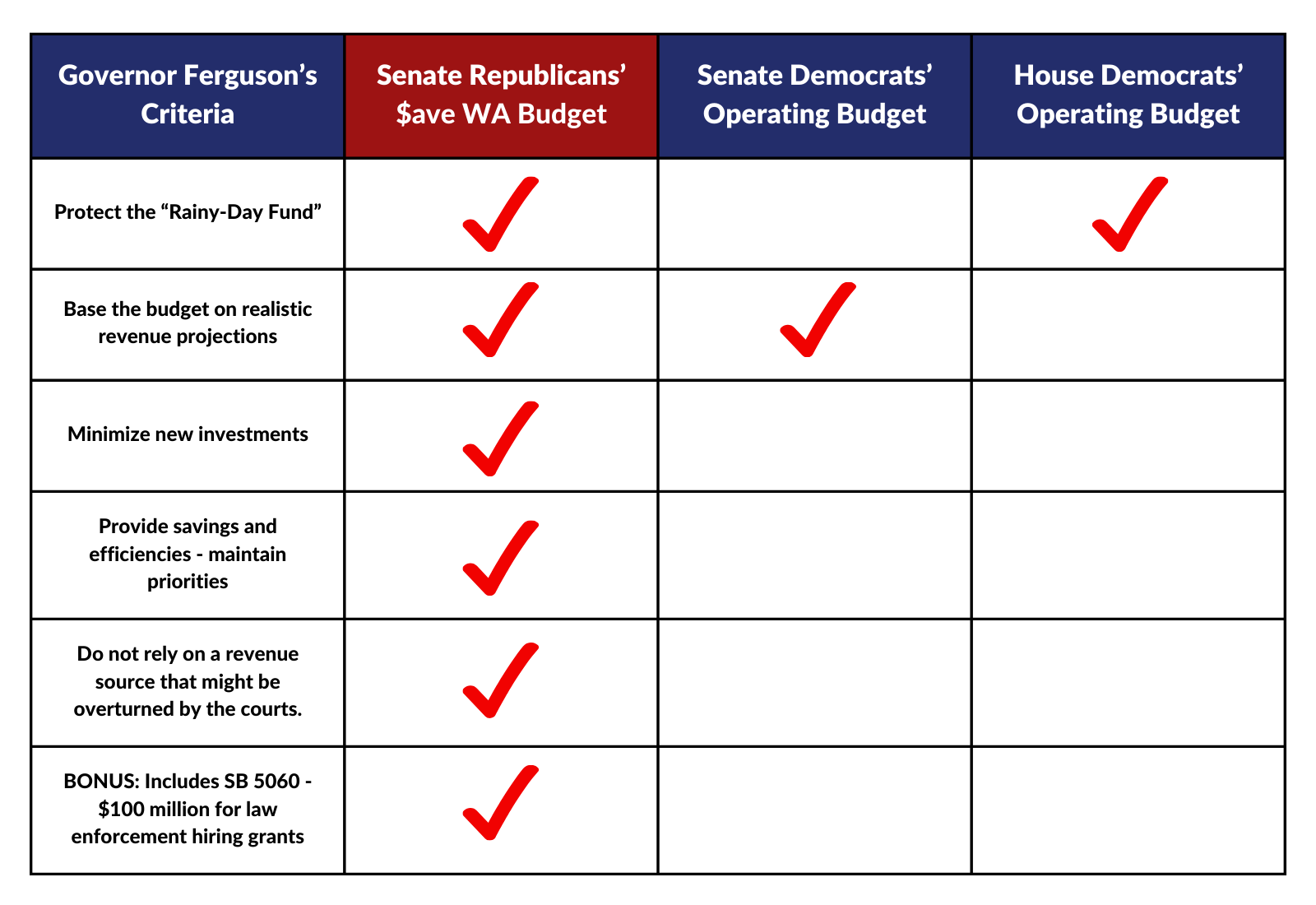

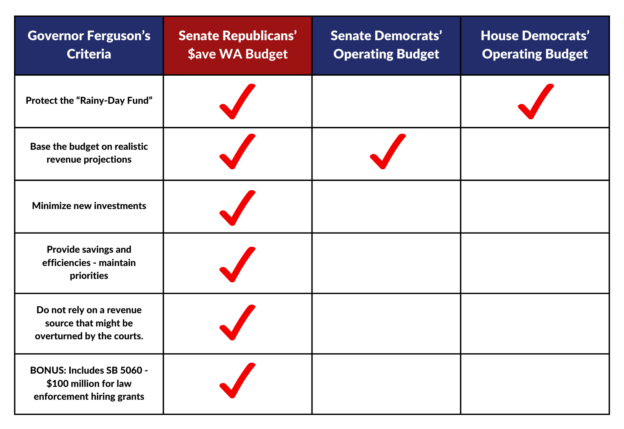

“It didn’t have to be this way. The Legislature could have gone with a budget like the ‘$ave Washington’ plan proposed by Senate Republicans – no new taxes, no cuts to existing services, no touching the ‘rainy day’ fund and no outspending the available revenue. But the majority said no twice. That needs to be remembered, especially if their budget collapses.”

Lawmakers this year faced a $7.5 billion shortfall, caused by chronic Democrat overspending. The majority inflated the shortfall to $16 billion and used that incorrect number to justify its record tax increases: $9.3 billion at the state level and another $2.9 billion locally, both over four years, including a property-tax increase.

The first-quarter forecast for 2025, adopted about five weeks before Democrats approved their new budget, was down $479 million for the 2025-27 budget cycle and fell $420 million for the 2027-29 budget cycle.