OLYMPIA… Today the Senate majority approved a sales-tax increase that will hit lower- and middle-income families harder, a tax increase that will drive capital out of Washington, and a collection of unrelated tax increases that includes a new tax on self-storage rentals.

Sen. Chris Gildon of Puyallup, Senate Republican budget leader, offered this reaction to the onslaught of new tax bills:

“Today was a very expensive day for the taxpayers of our state, and unfortunately, the majority is just getting started. The three tax bills Republicans opposed today are just part of the Democrats’ effort to impose the largest tax increase in state history on the people of Washington.

“Just two days ago Governor Ferguson said $12 billion in new taxes is too risky. The Senate majority responded today by supporting bills that total more than $10 billion in new state and local taxes – and that’s not counting the billions in taxes that are still ahead, through a business-tax increase and a very harmful property-tax increase. It’s like they want to have a showdown with the governor that drags the Legislature into a special session.

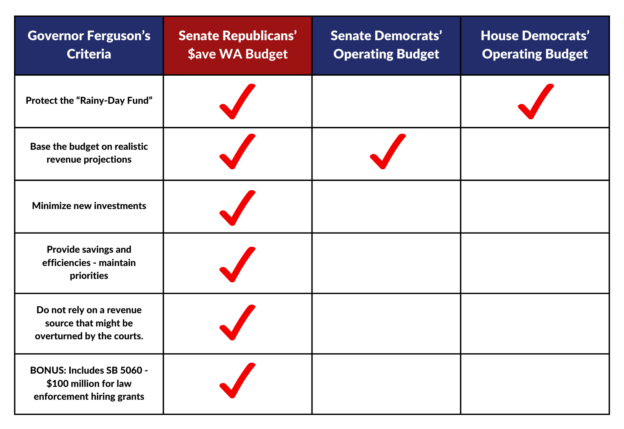

“Our Democratic colleagues kept saying over and over today that all these new taxes are needed to support popular services. That simply isn’t true, and our no-new-taxes “$ave Washington” operating budget is proof. We gave the majority an opportunity to join us in bringing our plan to a vote, but the answer was no – even though it also gives our state the flexibility to respond to anything that comes out of Washington, D.C. I realize our budget may not fully satisfy some of the special interests that are looking to the majority to deliver, but our plan respects the taxpayers – and with eight days left in this session, it also offers the surest way to finish our work on time.”

Sen. Nikki Torres of Pasco, assistant budget leader, said this:

“Just today I heard the governor say he wants a balanced budget that doesn’t increase taxes on working families – then I watched the Senate Democrats pass a multibillion-dollar sales-tax increase that will hit working families. They can call it ‘modernizing the sales tax’ all they want, but this is still going to take more money from the people who can least afford to lose it.

“As bad as today was for the budgets of families across Washington, there is more trouble ahead. The Senate Democrats are looking to turn Senate Bill 5798, their bill to eliminate the 1% cap on the annual growth of property-tax rates, into a complete and costly rewrite of the education-funding reforms made many years ago after the McCleary court decision. It’s unbelievable that this is coming up with just a week to go in the session. Homeowners and renters deserve better, and so do our students and school districts.

“The best answer of all is to avoid a property-tax increase altogether. The combination of higher property taxes and higher sales taxes would be even harder on working families, which is not what Republicans or the governor want.”