Click here to view this week’s report from the legislative session.

Dear Friends and Neighbors,

My video report focuses on two of the taxes being proposed by Senate Democrats that would cause the most harm to the budgets of families in the 25th District and statewide. One is a gas-tax increase, the other is a property-tax increase.

Two important things have happened since I taped my report: one good, one bad.

Budgets have ‘far too much’ in taxes, governor says

Gov. Bob Ferguson announced he won’t sign a new budget that relies so heavily on what Democrats call the “wealth” tax. This is good news, because Republicans see that tax as discouraging the innovators that have created so many jobs in our state.

We also suspect the tax would ultimately fail to do what the supporters hope because of what’s called “capital flight.” That means the people who are well-off enough to be hit by such a tax are smart enough to figure out how to protect their assets from it.

Governor Ferguson also said the budgets adopted by the Senate and House have “far too much” in new and higher taxes. I appreciate that, and would go a step farther: we can have a new budget that doesn’t include any tax increases. Our $ave Washington budget is proof.

My reaction to the governor’s announcement is here.

Goodbye, transparency and trust

Now that they know the governor would veto their “wealth” tax, the Senate and House Democrat budget writers need to go back to the drawing board and figure out how to make up for the loss of that tax option. The trouble is, they will do that out of the public’s view.

Here’s what happened: on Monday night the House Democrats adopted their budget proposal, as an amendment to (or rewrite of, in this case) the Senate Democrats’ budget. That came back to us, and this morning, the Senate voted to reject it. So far, so good.

Ordinarily, that would force the House to come back with a different set of changes, and we would begin pitching the budget back and forth, changing it each time, until a compromise is reached. This would all be out in the open, where the public can see it.

However, the Senate Democrats also voted to request a “conference,” which is allowed under legislative rules. This means Senate and House budget leaders will basically go into a back room and work for the next few weeks on a deal that resolves the differences between their two plans.

The motion to continue the budget work in secret was approved on a party-line vote. To view the debate that preceded the vote, and the vote itself, click here. Just as the Senate Democrats didn’t make a strong case for rejecting our $ave Washington budget when we forced a floor vote on it Saturday, they also didn’t make a strong argument for taking the remaining work on the budget out of public view.

Once a deal has been cut, they will emerge and present their “report” to the Senate and House membership for a yes-or-no vote. No public hearing, no opportunity for amendments on a budget no one else has seen — just four Democrats deciding how to spend the better part of $80 billion of your tax dollars.

The conference process makes sense when the competing budget proposals aren’t far apart and time is short at the end of a session. Instead, Democrats are opting to hide behind closed doors, with weeks to go and a gigantic hole to fill on the revenue side because of the governor’s opposition to how much the majority relies on the “wealth” tax.

So much for transparency and trust in government. This is an abuse of legislative rules, and bad news all the way around.

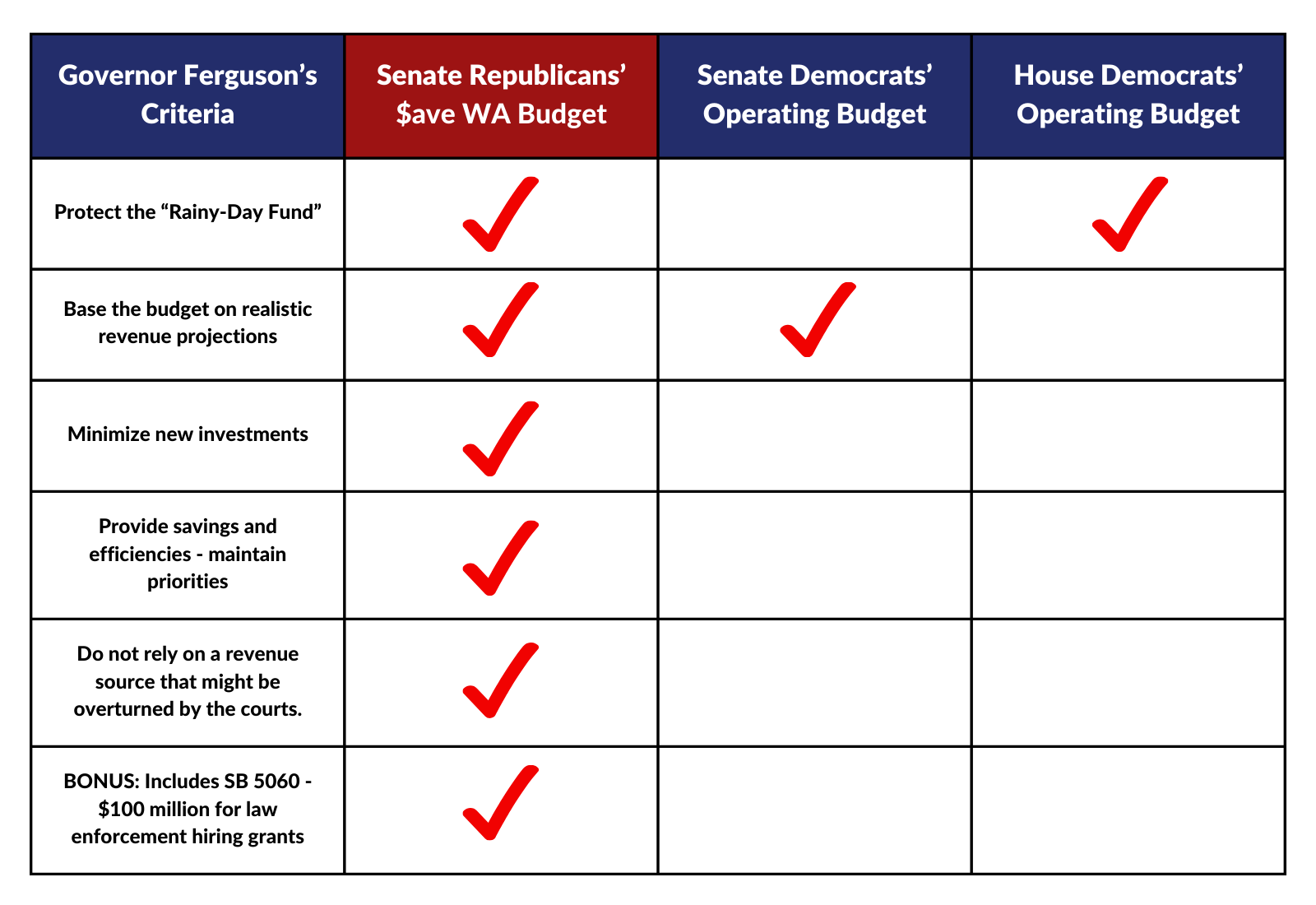

One more thing: In addition to saying the Democrat budgets fall short of his standards on the tax side, Governor Ferguson laid out a half-dozen criteria he wants the new state budget to meet.

The Democrat budget writers are going to have a heck of a time figuring out how to come up with a new plan that meets all those standards. But happily, Senate Republicans have the solution. Our $ave Washington budget checks all of the governor’s boxes, in addition to avoiding tax increases and cuts in services. Democrats should take another look at it!

The best part of today: Welcoming the 2025 Daffodil Festival royal court to the Capitol! I am also prime sponsor of the Senate resolution adopting in honor of the festival, which includes the names of this year’s princesses. This photo was taken afterwards, in the Capitol Rotunda in front of the Senate Chamber. Sadly, the Senate will be in session this Saturday, and there’s also a budget committee meeting scheduled, so I don’t see being able to attend even one of the four parades. But the weather should be great for those of you who can!