Click here to view this week’s report from the legislative session.

Dear Friends and Neighbors,

It’s day 96 of this year’s 105-day legislative session. By now we’ve been able to see which bills are considered priorities by the majority, and which are not.

The majority has approved several bills that can be collectively described as efforts to increase government control over more parts of our lives.Click on the video above for my report on those.

Unfortunately for the families across our state that are struggling just to get by, Democrats also are clearly determined to push a number of tax increases through this year. Keep reading for more about those.

Where we are in the session

All but one of the deadlines for taking action on bills have come and gone (the final deadline arrives April 27… because we’ll adjourn that day). Much of what we do on the “floor” of the Senate chamber from here on out will fall into one of two categories.

One category is debating and voting on budget-related bills. Those include the massive tax increases that are being hustled through the process.

The second is called “concurrence.” Suppose a bill passed by the Senate goes to the House, which also approves the bill but after making a change to it. The next step is for the bill to come back to us to see whether we “concur,” or agree, with the change made by the House.

If the vote is to concur, the bill will have received approval from both chambers, and will head to the governor for what is typically a ceremonial signing (although sometimes the signing is mandatory to put the new law into effect). If we don’t agree with the House’s change, a few other things can happen. One way or another, the differences of opinion usually get worked out.

Majority party is moving its new tax bills quickly

On Wednesday the majority Democrats in the Senate and House joined forces to introduce a another tax package — five bills costing around $18.5 BILLION in all, to go along with the other taxes they had introduced separately about a month ago.

Those five bills were rushed through public hearings later Wednesday in the Senate Ways and Means Committee. Today two came in front of our committee and were approved by the Democrat members: an expanded sales tax on services (SB 5814) and an expansion of the tax on capital-gains income (SB 5813).

The majority members also approved a version of the so-called “wealth” tax (SB 5797) that had already received a public hearing in our committee back on March 31.

When the full Senate is in session tomorrow (Saturday), I expect there will be debates and votes on these three big tax bills. Think about that for a moment: less than four full days from introduction to potentially moving out of the Senate. It’s like the majority wants to ram these tax bills through before any opposition can organize.

It’s my understanding that the House Finance Committee will take up three more big taxes tomorrow: a property-tax rate increase (House Bill 2049), an expansion of the tax on businesses (HB 2081) and a tax on automakers that sell certain electric vehicles (HB 2077, nicknamed the “Tesla tax”).

The “make the wealthy pay more” messaging we’ve heard from Democrats all session long is a farce when you consider how raising the property tax and sales tax hits almost everyone regardless of income level.

Governor calls new tax package ‘too risky’ — and he’s right

To his credit, our new governor has again stepped up and voiced his concern about what his fellow Democrats are doing. I encourage you to read his comment (linked here) first, then my response will make more sense (it’s linked here)..

Also, this newspaper editorial from Wednesday gets it right about the need for sensible lawmakers to avoid going over a cliff by following “the Legislature’s left-leaning Democratic leaders.”

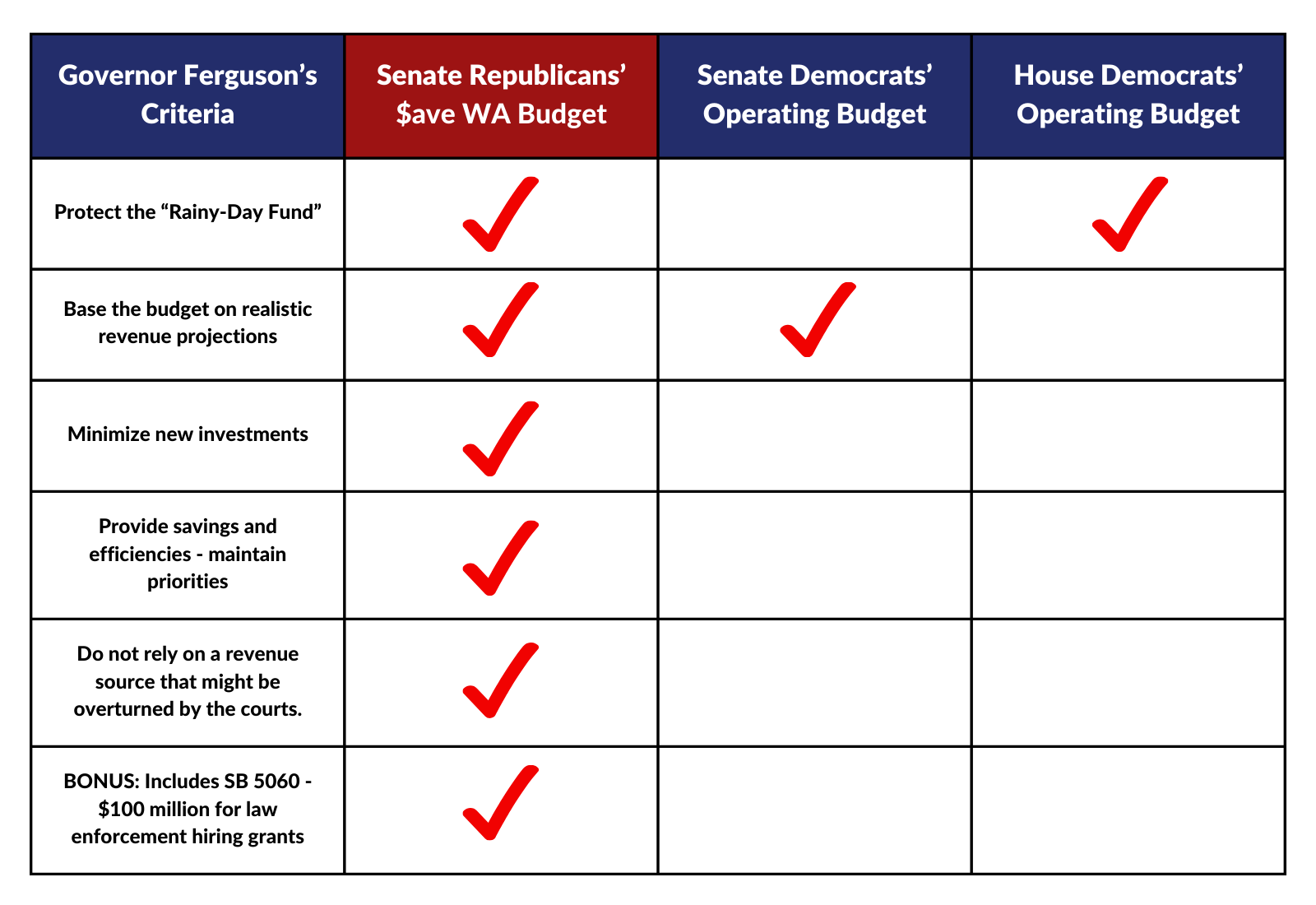

Republicans certainly see the danger in the Democrats’ agenda. We also know there’s a better way to budget, in the form of the $ave Washington plan (Senate Bill 5810). Unfortunately, it will take some bravery from several members on the majority side to derail the massive and unnecessary tax increases their left-leaning leaders support — and that’s what worries me.

During a lengthy interview yesterday on KVI Radio, I spoke of how calling something a business tax is inaccurate in the sense that consumers end up shouldering the taxes and other costs imposed by government — and also, how the property-tax and sales-tax proposals are my greatest concern.

Your Input Matters

I am committed to representing your interests effectively and I welcome your feedback and suggestions. You may contact me at:

- Chris.Gildon@leg.wa.gov

- 360-786-7648

It is an honor serving you and I look forward to your continued engagement and support!

Sincerely,

Sen. Chris Gildon, 25th Legislative District